Tax calculations

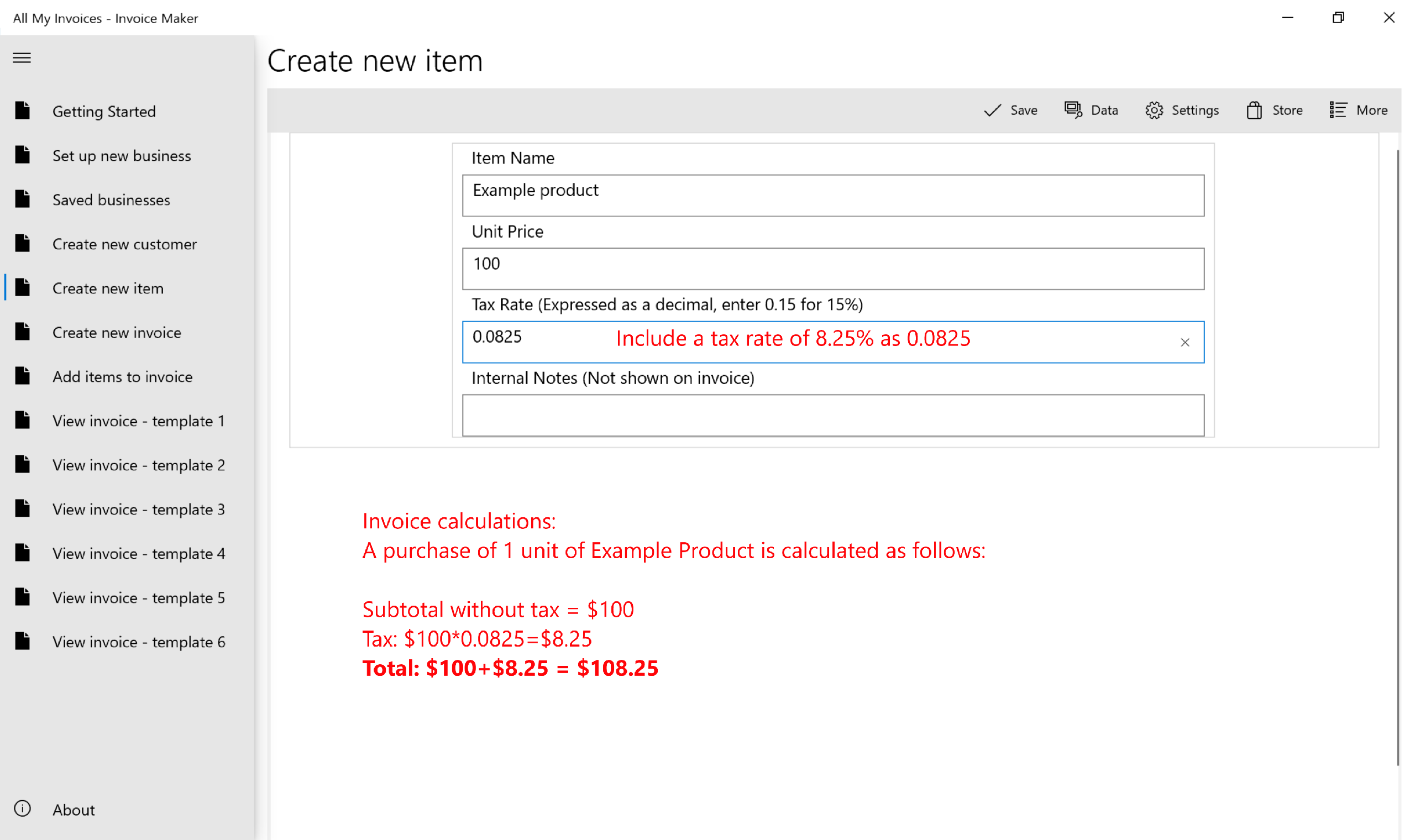

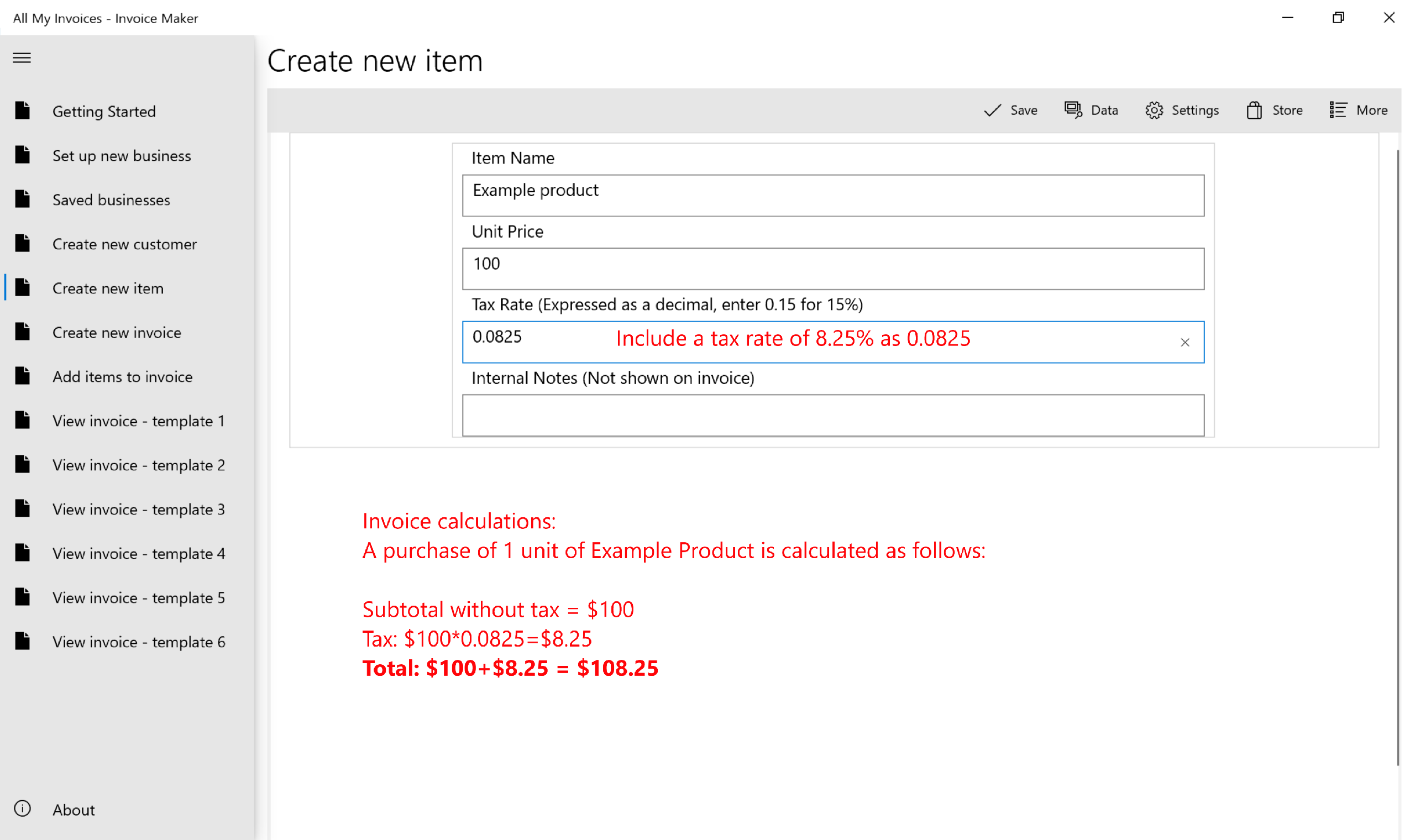

How to create a new product with a tax rate

In this example, let's add a new item with a 8.25% tax rate.

- Go to "Create new item" and enter the following attributes:

- Name: "Example Product"

- Price: 100

- Tax: 0.0825

- Click on "Save"

A purchase of 1 unit of Example Product is calculated as follows:

Subtotal without tax = $100

Tax: $100 x 0.0825 = $8.25

Total: $100 + $8.25 = $108.25

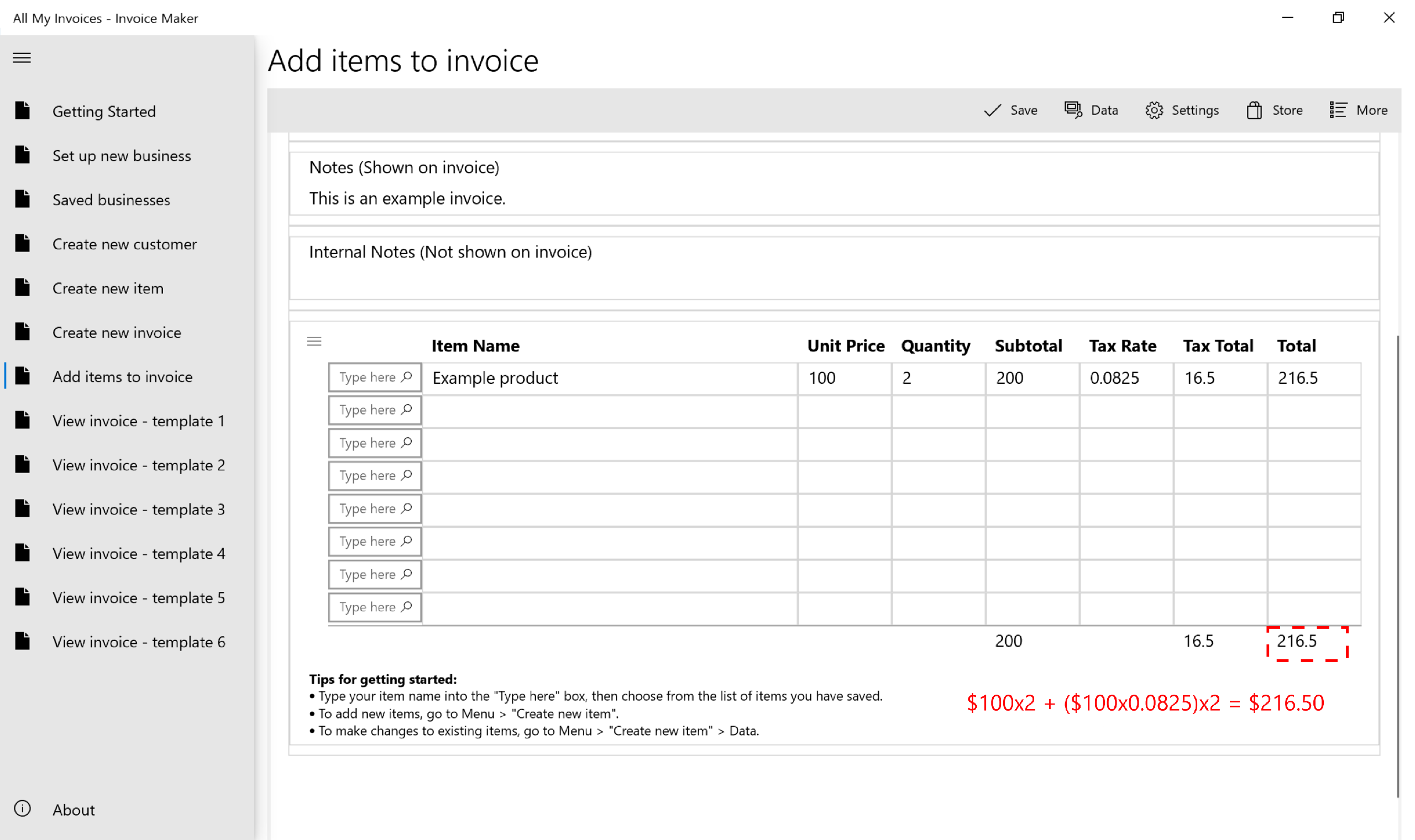

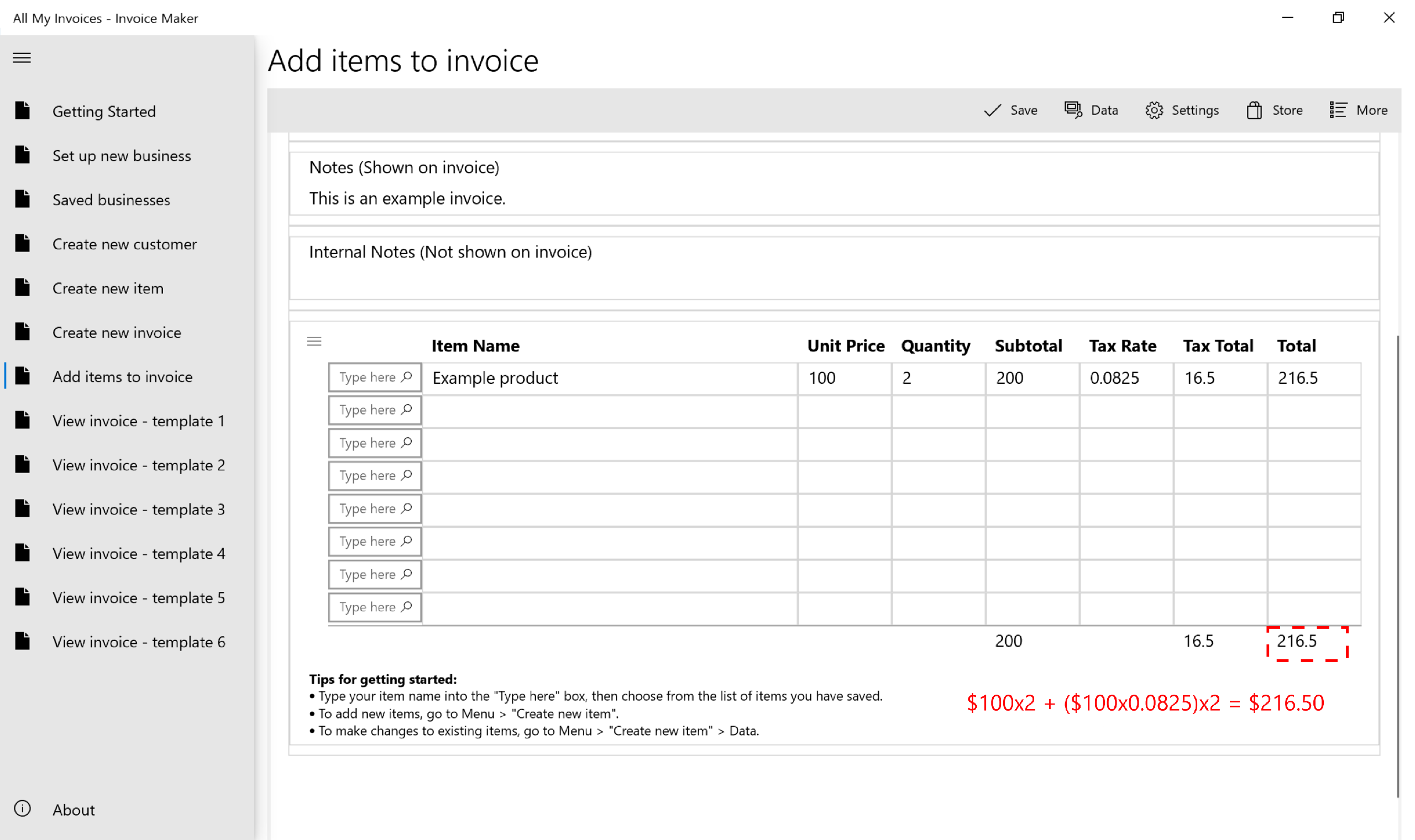

How to add a product with a tax rate to the invoice

- Create a new invoice by going to "Create new invoice" (note down the new invoice number)

- Go to "Add items to invoice" and select the new invoice created in step 1

- Scroll down to transaction table, type "Example Product" in the first entry, select "Example Product"

- If you have multiple products with the same name, please review price and tax rate details to make sure you have the correct selection

- "Product Name", "Unit Price" and "Tax Rate" will be auto-populated based on information you entered when creating the item

- Enter purchase "Quantity". For this example, let's enter a quantity of 2.

- Review calculated subtotal, tax and total

A purchase of 2 units of Example Product is calculated as follows:

Subtotal without tax: $100 x 2 = $200

Tax: ($100 x 0.0825) x 2 = $16.50

Total: $200 + $16.50 = $216.50

![]()

![]()